The U.S. Department of Labor Office of Unemployment Insurance Division of Fiscal and Actuarial Services has released its annual state Unemployment Insurance State Solvency Report. The annual report describes in great detail the current solvency of the state unemployment insurance systems.

DOL reports that 23 states have trust funds that are below the department’s recommended minimums. Twenty-nine states are meeting or exceeding the department’s recommendations. This is by far the best condition of the country’s unemployment insurance safety net since the Great Recession.

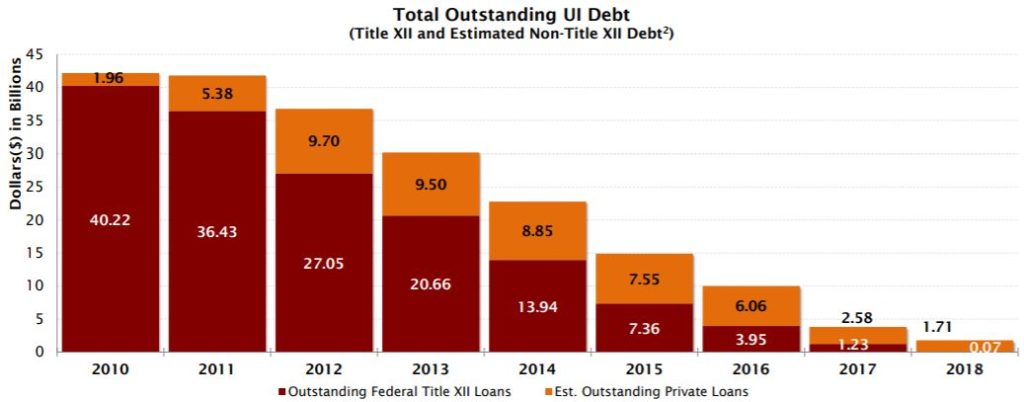

As a result, the outstanding federal loan debt owed by the states and other U.S jurisdictions from the money they borrowed during the recession to be able to meet their legal obligations to unemployment claims filers is at it’s lowest rate in almost a decade – now only $68 million. At the height of the recession, states owed over $40 billion dollars in federal loans.

Two states still have outstanding private debt of approximately $1.7 billion, but that is the extent of the money owed.

Nonprofits Have Other Options

The above applies to all employers except 501(c)(3) organizations. 501(c)(3)s do not have to pay state unemployment insurance taxes – high or low. Many nonprofits could save as much as 30 percent more on their unemployment cost by opting out of the unemployment insurance tax system – an advantage provided to them by the IRS. Doing so affords nonprofits unique avenues that allow them to strategically handle unemployment claims administration and unemployment insurance taxes in ways that for-profits can only dream about.

Contact us today for more information concerning your nonprofit unemployment insurance tax advantages.