The 2016 State Unemployment Insurance Report has been released by the U.S. Department of Labor’s Office of Unemployment Insurance. The publication of the report provides an opportunity for interested parties to evaluate and compare the solvency level of each state’s Unemployment Insurance trust fund reserves.

As we have written before, the nation’s unemployment insurance safety net is not healthy.

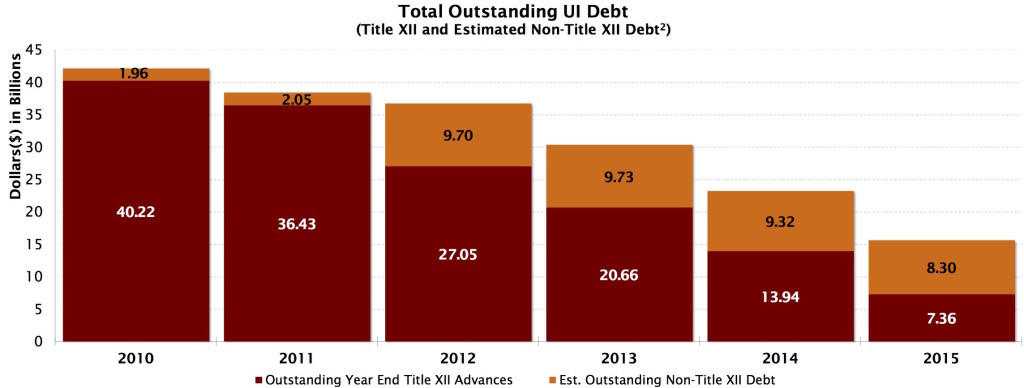

According to the DOL report as of the end of 2015, four states and jurisdictions (California, Connecticut, Ohio and the Virgin Islands) still had outstanding loans to the federal government totaling $7.36 billion. Six states (Colorado, Illinois, Michigan, Nevada, Pennsylvania and Texas) have outstanding private loan and debt service obligations totaling $8.3 billion.

The amount outstanding in alternative financing is now higher than the amount remaining in outstanding loans from the federal government and will likely remain at a higher total in 2016 and 2017.

Only 18 states have state unemployment benefit account balances that equal or exceed the US DOL guideline for solvency. Many states have enacted solvency measures since the 2008-2009 recession; however, many states do not have sufficient balances to avoid borrowing in the event of increased claims load that would come with the next recession.

Nonprofits Have Other Options

The above applies to all employers except 501(c)(3) organizations. 501(c)(3)s do not have to pay state unemployment insurance taxes – high or low. Many nonprofits could save as much as 30 percent more on their unemployment cost by opting out of the unemployment insurance tax system – an advantage provided to them by the IRS. Doing so affords nonprofits unique avenues that allow them to strategically handle unemployment claims administration and unemployment insurance taxes in ways that for-profits can only dream about.

Contact us today for more information concerning your nonprofit unemployment insurance tax advantages.